Credit Score – What is it?

Credit score is a record showing how timely you’ve been able to pay back the credit union and other financial institutions on the credit and loans you’ve borrowed.

Credit Score is affected by what is paid off from a credit card. When a credit card is used, it has to be paid back by a certain date. If you miss the date agreed upon to pay off the card, are late with the payment, or don’t have the money for one reason or another, it affects your credit score. Negative actions on a credit card mean negative score on your credit record.

Tips to get good credit score:

- Open a revolving limit on a Credit Card, and paying for small amounts on the card to start off will help in establishing a good credit score. Start by creating constants by paying off small amounts but ensuring that they are paid on time.

- Keep balances relatively low on your existing credit cards. “A full 30% of your credit score is determined by how much you owe. High credit card balances can be especially damaging. Your credit utilization ratio — your balance divided by your credit limit — should be below 30% on each credit card. For example, if you have a credit limit of $10,000, it’s recommended to keep the balance below $3,000,” according to Investopedia.

- When using a credit card it is commonly advised to use them with caution. Although you may have a large limit of how much you can spend on them, the lower the amount of credit is used, the better our credit score will end up.

- Remember, your credit score is only affected by things that connect to your credit, and doesn’t have anything to do with a user’s debit card.

- It is widely recommended that a lower balance of credit equals better score. This can be acknowledged by the fact that with a lesser amount of credit, less is available for a user to spend and there is less of a risk of not being able to pay it off. Plus, large purchases not paid off can look worse on your credit score than missing a smaller purchase.

- Start with a lower limit. To start a good line of credit, it is recommended to start with a simple credit card. Typically members start off with small amounts, until getting into a habit of paying them off is natural and certain it can be done.

- Amount of people on a credit card doesn’t matter and doesn’t affect what your score will look like in the end. Joint owners is an available option for credit cards, but as long as the credit is paid off, the amount of owners doesn’t matter.

- Besides credit cards, how a member of the credit union pays off loans will affect their credit score as well. Your excellent payment history positively affects your score. Revolving debt from a credit card is good, because it is constantly there and can strengthen your score over longer periods of time. Unlike loans, credit cards don’t have an expiration or end date.

- There is no limit on how many credit cards a member can have, however users must be extremely careful with using too many cards. More cards means more money and more credit to pay off, and more of a risk that you won’t be able to pay for everything in the end. Know your assets and the limits as a user you can spend.

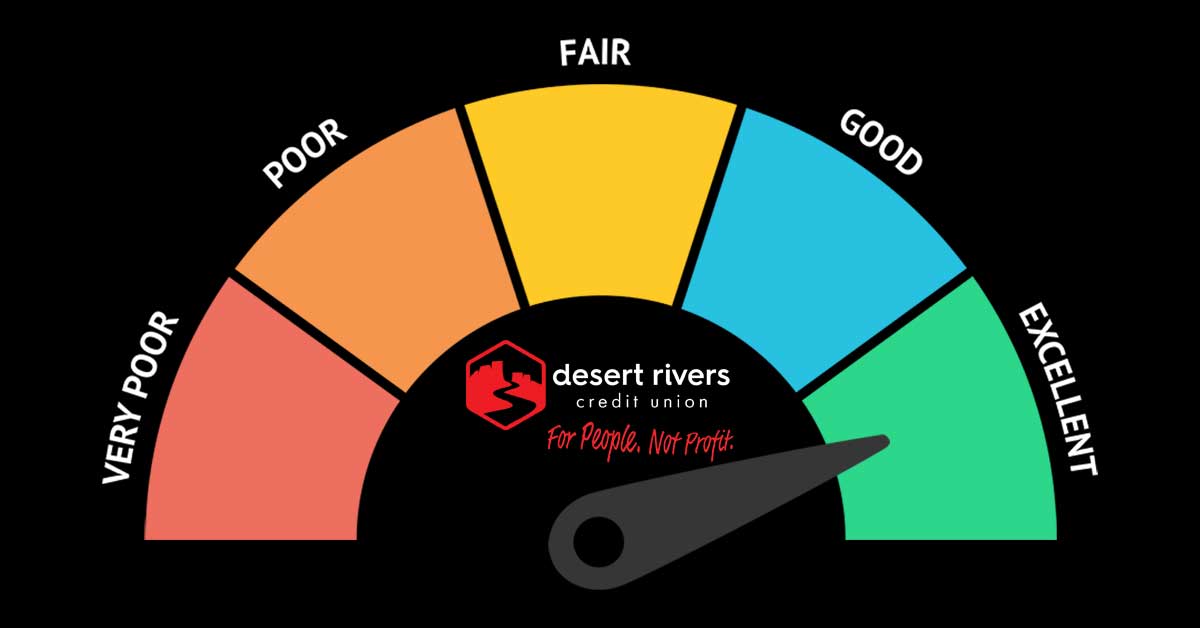

What is good Credit Score?

Credit Score is measured in numbers. The higher that number is, the better your credit is. But the less smart moves that are made with your credit, the more the number goes down, and so does your score and ability to get loans and other things you might need. Experian uses FICO® Scores, created by Fair Isaac Corporation. According to Experian, a score of 670 or above is considered a good credit score, while 800 or above is considered exceptional. The scores range from 300 to a maximum of 800.

The Desert RIvers Credit Union works closely with its members with loans and credit cards. Opening a credit card at our credit union is a good first step to building a good credit score and a logically sound move.