Investing 101

I’ve worked at or with credit unions for over 40 years and I’ve seen most every mistake that can be made by investors. A few, either by good luck or by research and study, become very successful. They protect their initial investment and get a very nice return. More often, however, I see people “follow” the prevailing fads and often, frustratingly, lose large portions of their investments.

Probably the best advice I ever received was to never invest in something I didn’t completely understand. This little article is an attempt to help people re-visit and better understand the value of investing in Savings Certificates (also called a Certificate of Deposit or CD). It was probably the most popular investment in the 1980’s when interest rates on Savings Certificates were over 10%. Less popular the past several years as rates dropped below 1%. However, as rates continue to rise over the past year, it’s time to re-consider the value of this safe, smart and strategic investment.

What are some of the most common investments?

- Savings Certificates – also referred to as “Certificates of Deposit” or CDs. These have been used by conservative investors for generations

- Stocks – Also known as shares or equities and is an ownership in a company. For example, you can buy General Electric, Verizon or Apple stock and benefit from dividends and the growth and appreciation of a company.

- Bonds – With a bond you’re buying debt in a company or a government. Essentially, you’re loaning your money directly to a company or government.

- Mutual Funds – These are a pool of investor money that may buy a number of investments that usually include stocks or bonds.

- Others include Annuities, Commodities and Cryptocurrencies. Other investments definitely have their benefits but only buy when you fully understand the commissions involved, the potential volatility and the risk to your initial investment.

All of these investments have their place in a well-diversified and strategic investment portfolio. Too often, however, new investors skip past the more conservative investment directly to investments that are extremely volatile and risk their initial investment to the extreme. Cryptocurrencies or Stock Options for example. This article is to remind you of the easiest and most logical investment for most investors. This is the investment most of your grandparents relied on until they had the money and expertise to diversify into Stocks and Bonds – federally insured and very conservative Savings Certificates.

Why invest in Savings Certificates (CD)?

- They’re safe! You can never lose your principal because they are Federally Insured by the FDIC at banks and the NCUA (National Credit Union Association) at Credit Unions.

- Good Return! Banks and credit unions use Saving Certificates to loan money to their customers and members. Often times, the interest rates get bid up to the point that the return is better than many Government Bonds and more than even the more risky Corporate Bonds.

- There is no commission. You don’t have to pay a broker a percentage or a commission to invest. Bankers are just happy to get your money so they can make loans. Brokers don’t help you out for free and they generally get a fee from an upfront commission, backend commission, annual fee or by taking the difference between the sell price and the buy price. Often times, their expertise may be worth the money but make sure you understand what you’re paying.

What are the negatives of a Savings Certificates?

- You’ll have to pay taxes on the interest you receive unless you buy the Savings Certificate (CD) through an Individual Retirement Plan or other retirement plan. Not surprising really, the more you make, the more you generally pay in taxes.

- There may be an opportunity cost if Stocks go up 25% next year and you’ll miss out on that. (If you can guess what Stocks will do next year, you can make a lot of money. However, if you’re like me, you’ll likely guess wrong and your Stock Portfolio could go down 25% or more.)

- Banks and credit unions sell Savings Certificates so they can count on your money for a fixed term. As a result, they’re willing to pay you a higher interest rate than Regular Savings but they also impose a penalty if you withdraw your money before the maturity date.

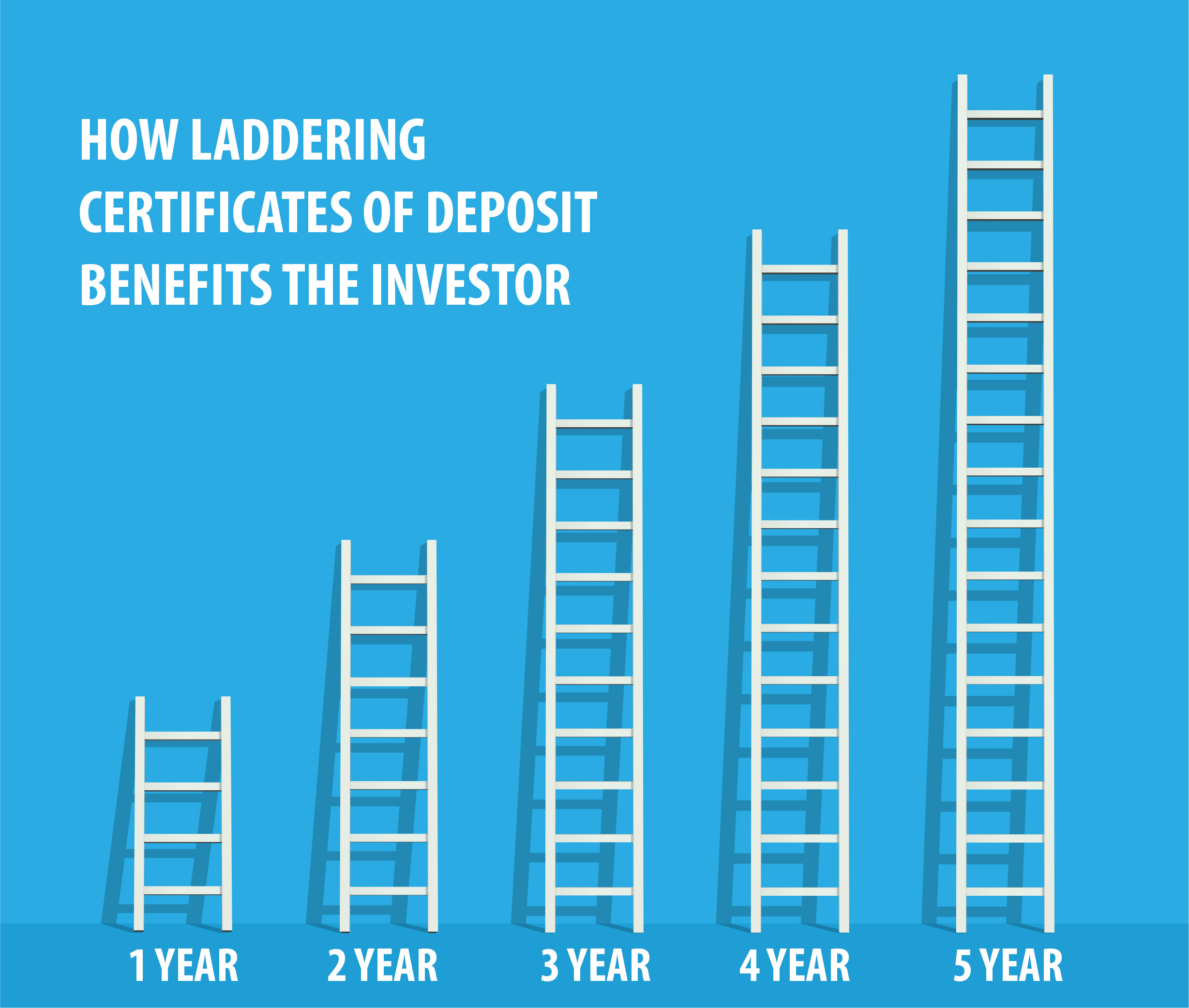

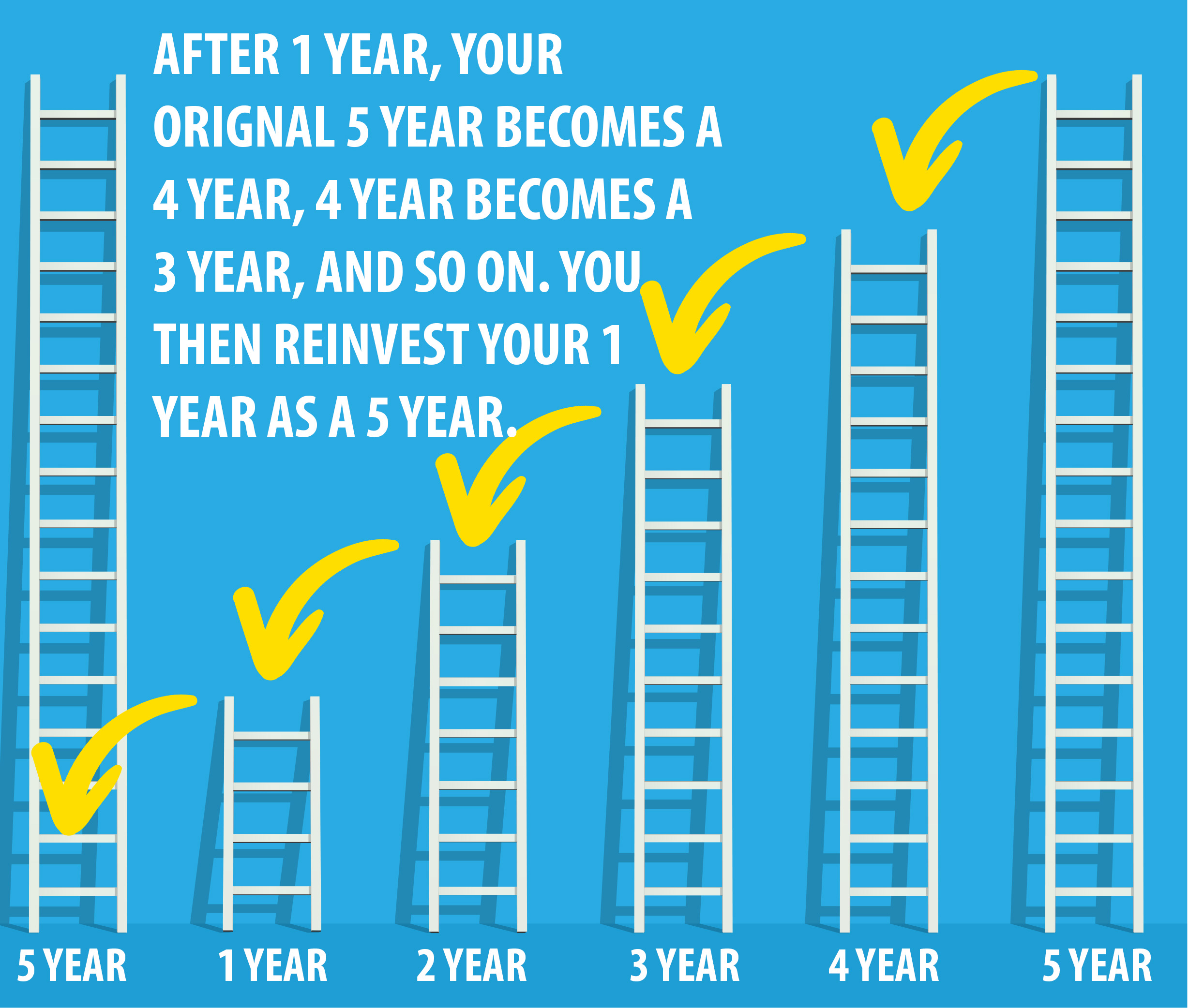

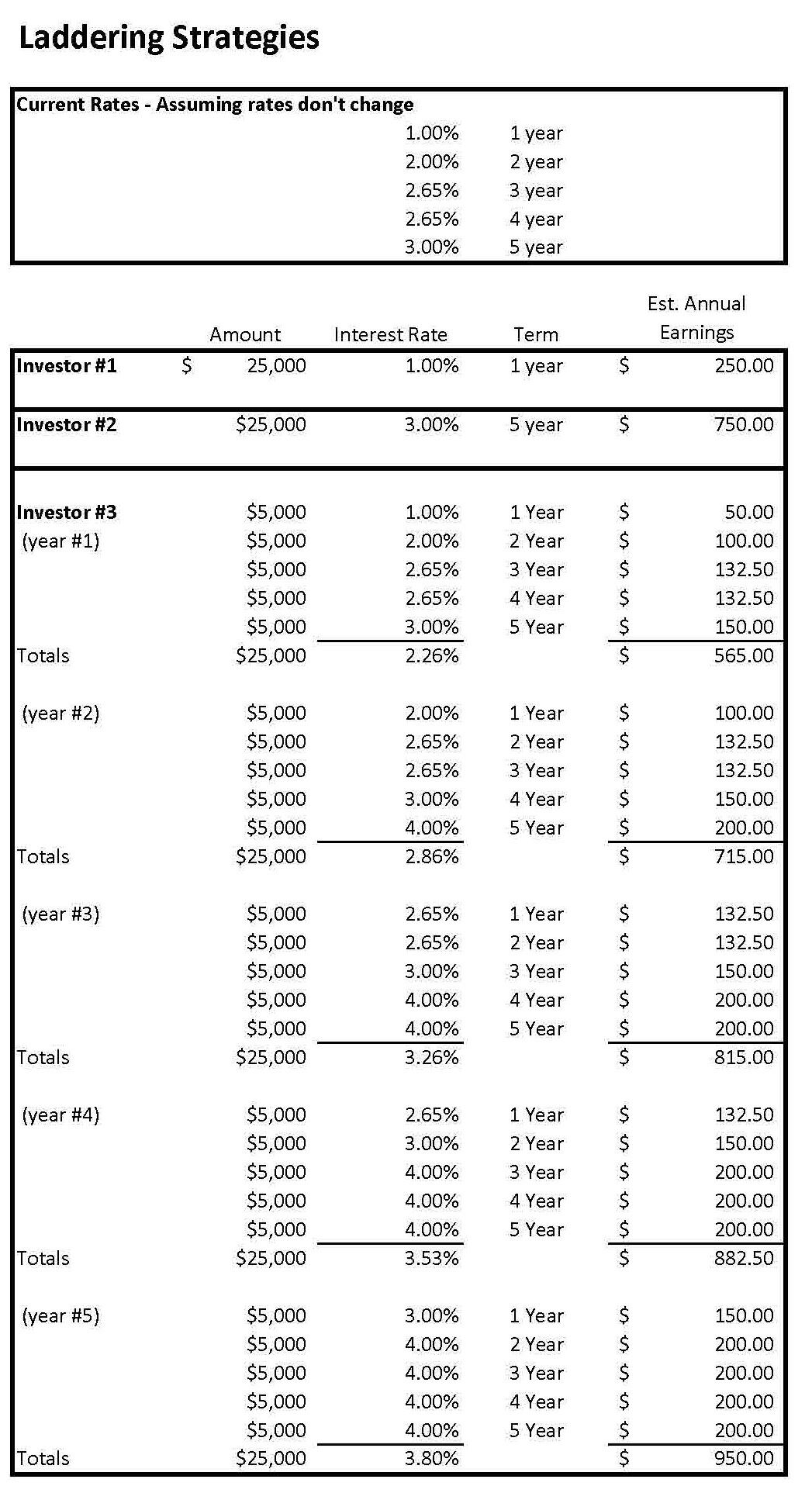

I think you’re getting the idea. I have friends and family who have accumulated well over a $1,000,000 in their lifetime from simply putting an amount into their Savings Certificate on a monthly basis. They’re successful without being an investment guru and frankly, it’s convenient to make a deposit monthly at a bank or credit union. That said, there are a few strategies to consider when investing in general. One of those strategies is called “laddering.” It works with bonds as well as Savings Certificates. It’s most important, however, when building a Savings Certificate portfolio. The following example illustrates the power of laddering.